Why be a part of Milestones2Wealth?

Imagine your biggest aspiration or wealth creation goal. Set a date by which you think you should achieve this goal. Think about the distance you would need to travel and how much time it would take for you to get there. Seems tedious, right? Now, let’s try breaking your long-term goals into shorter-term goals. Seems achievable, doesn’t it?

Here is where Milestones2Wealth comes in. We at M2W understand the importance of milestones in your financial journey. M2W works towards understanding your goals, setting realistic milestones, and providing the tools you need to achieve those goals.

Our objective is to:

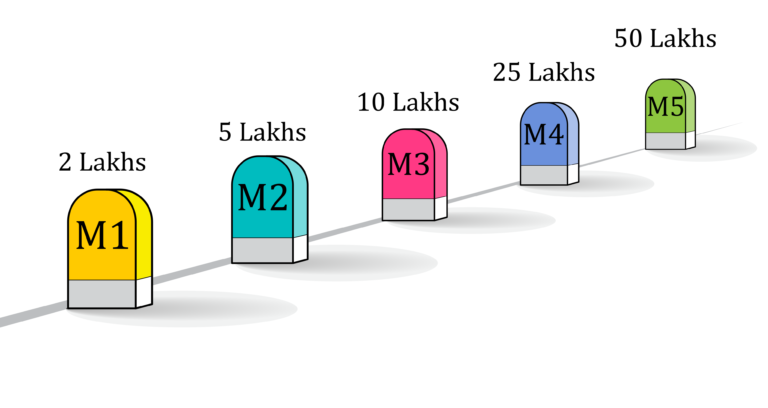

- Create a good investment journey from 0 to Rs. 50 Lakhs

- Prepare investors for bigger things

- Build an educated investor community

- Deliver investor education

- Ensure wealth retention & growth

Benefits

Reading Materials

Investment Talks

Viewing Content

Know What You Own

Masterclass

Milestones2Wealth

Milestones indicate the direction you must head towards, and the time it would take to reach each milestone. As you move past each milestone, your get closer to achieving your goals. Each milestone allows you to pause, review, assess, and course-correct when required. Setting milestones enables you, as an investor, to understand the essential aspects that go into investor behavior & decision-making.

Milestones

Know your income. Fix your expenses. Save at least 25% of your income. If you want to be a big saver, do more, save 50%. Only after you save, spend. Even after spending, see if you have saved something. Now you are ready with a saving habit.

Investing habit – Set your milestone with your savings. Check how soon you can get there. Get the right advice. Make the right choices. Set up your investment plan. Stick to plan. Measure performance regularly. Try and do more than you planned. Keep the noise out & stay focused.

Congratulations you have reached milestone 1. Did you make it before time? Then, you are ready to do more. Know your next milestone: 5L. Check how much you can invest. Try and raise your investment. Know when you will reach. Stick to the course. Try to do more. Stay focussed. Do more when it’s a good time. Keep the company with great advice. Act in time. Measure performance. Learn to achieve more.

Another milestone successfully reached!

You have cracked the code on what it takes to reach your goal. The key from here on is to stay consistent and disciplined.

While your wealth grows, it is essential to secure it. Setting up a contingency reserve and having adequate insurance will ensure that your hard-earned money is well protected. You do not have to touch your savings or investments on a rainy day.

General rule of thumb is to save about 6-8 months’ worth of expenses in your contingency reserve. Buy insurance for insurance’s sake. Choose a policy that fits you. Stay away from glitter. Go for term insurance. Top it off with health insurance. That is all you need. Most importantly, remember to do more. As you grow your portfolio, you must grow your investing. What do we mean by that? We mean that you should increase your monthly savings, create liquidity to do lumpsums and imbibe the growth spirit in investing.

Congratulations! You are now a RUPEE MILLIONAIRE!

As you approach bigger milestones, be mindful of what it took to achieve previous milestones. Make your learnings a mantra and follow it diligently.

- Stay consistent with your investments.

- Review investments regularly.

- Take part in every investment opportunity.

- Avoid speculation.

- Plan & work towards fulfilling your financial & personal goals.

- Make asset allocation your best friend. Course-correct when needed.

- Do away with distractions. Stay focused on your goals.

Remember that you are now on growth mode. The growth culture which you imbibe has got you here. Learning to improve your growth culture will take you towards the next milestone. This is a big leap and big moves need better preparation. Patience is your strength. You need to grow it now. As you grow, you will learn that time is a significant contributor to your growth. You will learn to utilize time to your advantage.

M4 is a big milestone. It sets you up for a bigger milestone. Pat yourself on the back! Reaching ₹25 Lakhs is no easy feat.

You have learnt the secret to building sustainable wealth. The journey from ₹25 Lakhs to ₹50 Lakhs may seem like a leap. The secret to a worry-free journey is consistency and discipline.

- Invest when there is an opportunity. Review your investments.

- Stay on top of your personal and financial goals.

- Bump up your contingency reserve.

- Top up your insurance policies.

- Make asset allocation your friend.

Staying focused, sticking to what worked for you, getting the right advice, and turning opportunity into advantage is the key. Going from M4 to M5 is a phase where you prepare yourself for much bigger things. Remember that you are made for bigger things.